Irs Allowable Expenses 2025. The irs recently announced an increase in hsa contribution limits for 2025. The irs allows various tax deductions for expenses related to producing taxable investment income.

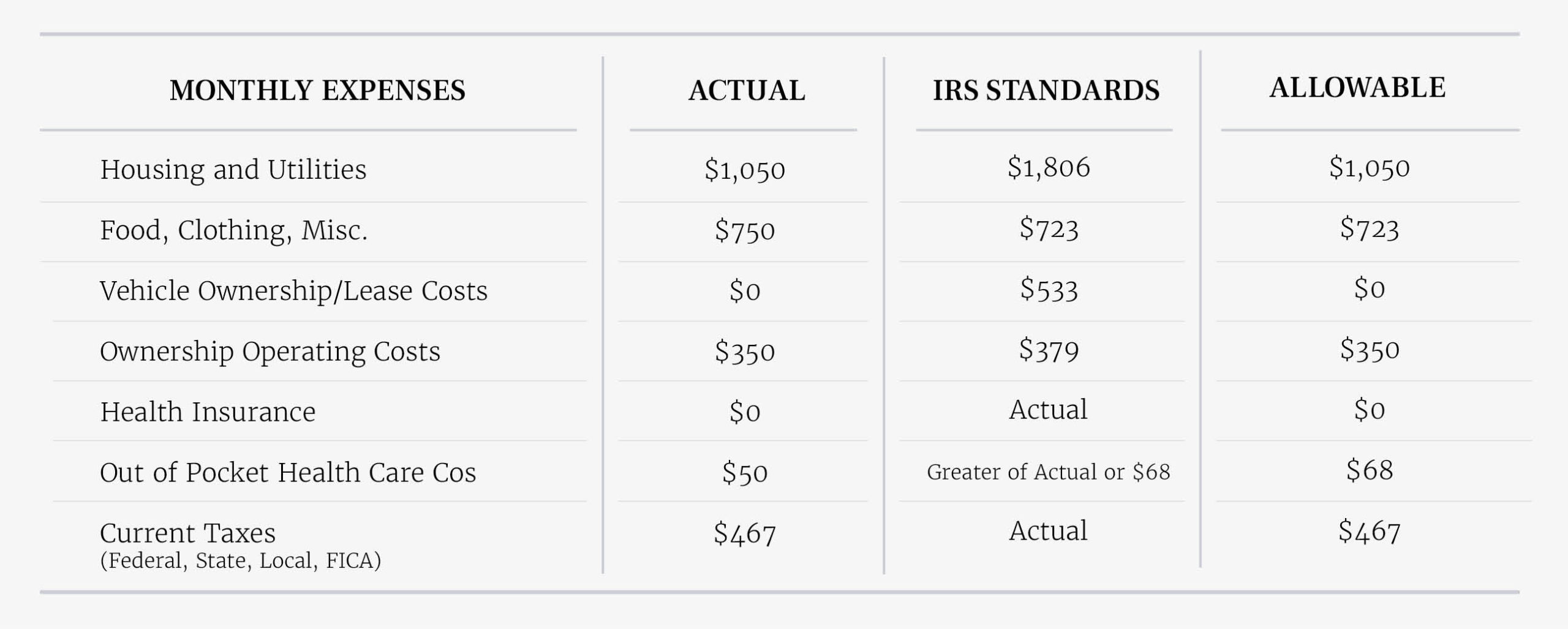

When you travel away from home on business, you must keep records of all the expenses you have and any advances you receive from your employer. The irs has updated the allowable living expense (ale) standards, effective april 24, 2025.the ale standards reduce subjectivity when determining what a taxpayer may.

What Are “Allowable Living Expenses” to the IRS? YouTube, The irs has updated the allowable living expense (ale) standards, effective april 24, 2025.the ale standards reduce subjectivity when determining what a taxpayer may. It includes information on the tax treatment of investment income and.

IRS Allowable Expenses Business tax, Debt help, Tax questions, The standard mileage rates for 2025 are: Only 50% of otherwise allowable meal expenses are deductible as business expenses (sec.

A Look at the IRS' Allowable Expense Standards, Only 50% of otherwise allowable meal expenses are deductible as business expenses (sec. The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,150 (up $50 from 2025).

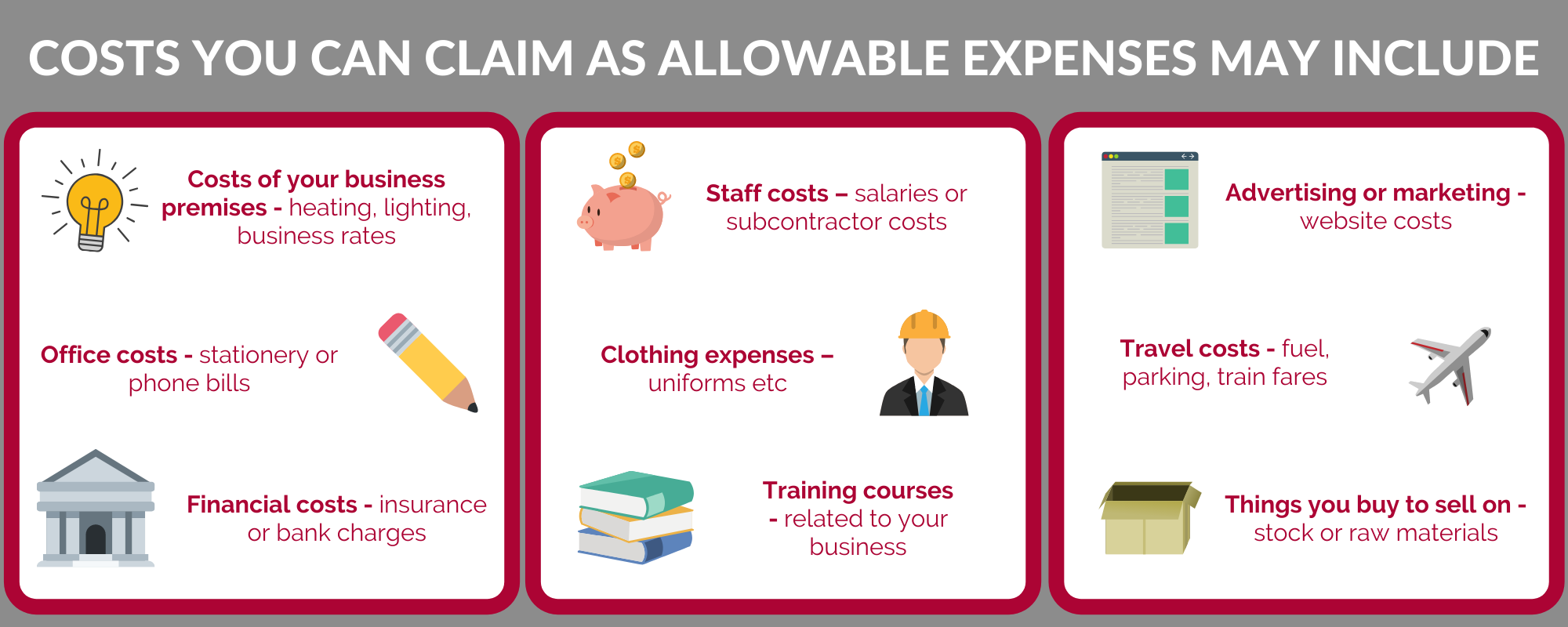

Selfassessment slash your tax with these allowable expenses David, Since maximizing your tax deductions has. The irs allows various tax deductions for expenses related to producing taxable investment income.

SOLUTION Allowable and disallowable expenses Studypool, The irs allows various tax deductions for expenses related to producing taxable investment income. Irs releases health savings account limits for 2025.

Personal Tax Planning How to get it Right Accountants Price Davis, The standard mileage rates for 2025 are: Moving ( military only ):

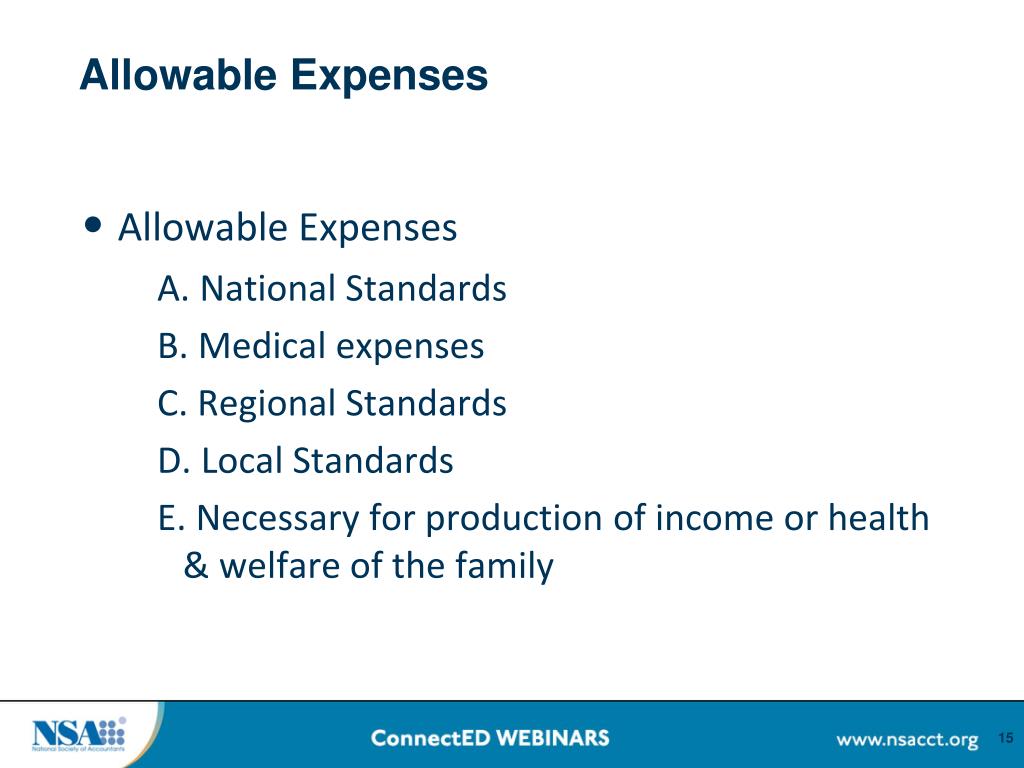

PPT IRS Collection Division Representation PowerPoint Presentation, It also provides guidance to. When you travel away from home on business, you must keep records of all the expenses you have and any advances you receive from your employer.

Ultimate Guide To Allowable Expenses Taxoo, This includes business meals while attending professional. The standard mileage rates for 2025 are:

Investment Expenses What's Tax Deductible? Retirement Plan Services, The irs has updated its website to provide the allowable living expense (ale) standards for 2025. The irs recently announced an increase in hsa contribution limits for 2025.

2025 Irs Allowable Living Expenses Alena Aurelia, Moving ( military only ): This publication provides information on the tax treatment of investment income and expenses.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).